Source: Neil Mullinieux: The new Car Market in Europe; page 12

The European Automotive Industry

MARKET ACTORS

Below we shall briefly discuss the seven largest actors in the

European Automotive indu-stry. This will be done with respect to

products, background and current situation Further we will supply

a small table of key figures for each company, where such data

has been available. As mentioned, we have not been able to obtain

the annual reports of Fiat and Renault.

The sources for this chapter are the annual reports, corporate

websites and the book "Di-rectory of Multinationals" by

John M. Stopford. As mentioned in section 2.5, we have not been

able to obtain the annual reports of Renault and Fiat, and thus

we have only limited information about those companies.

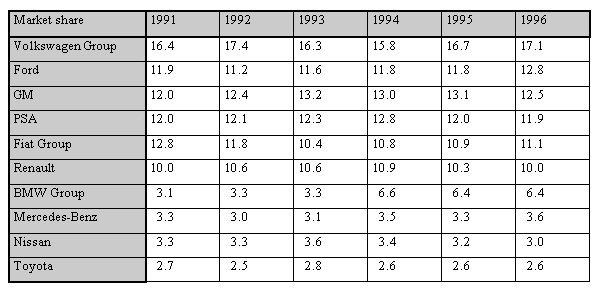

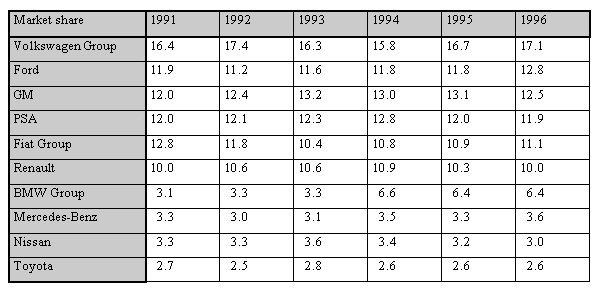

The table below shows, the development of market shares for the

10 largest companies in the period from 1996 to 1991.

Table 5.1

Source: Neil Mullinieux: The new Car

Market in Europe; page 12

The VW group produce a broad range of passenger vehicles and a range of light trucks powered by air-cooled, water-cooled and diesel engines. In automobiles, VW itself produ-ces the Polo small hatchback and coupe, the Golf small/medium hatchback and saloon, the Passat medium sized saloon and estate and Sciocco and Corrado sports coupes. In addition the company produces Audis A-range, which covers the top-end of the groups models . In the future the Audi brand will be given a more separate identity through own design, manufacturing and marketing functions. The beetle is still produced in Latin America and there are a variety of minibus derivatives based on the LT van and original. The cars are produced in several locations around the world and total sales in 1997 were over 4,2 million units worldwide. In the European market VW products also include the brands of SEAT and Skoda.

Table 5.2

Source: Neil Mullinieux, The new car

market in Europe; p. 7

The Group is also active in national and international finance

through its various leasing subsidiaries and the VAG Banks. These

provide wholesale and retail loans to customers. Further VW has

an interest in car rental through its stake in Europcar

International.

Background and Current Situation

VW originated in an association set up by a German government

agency in 1937 to ope-rate a savings scheme, through which

production of a "people's car" was to be financed.

During the War, the production facilities were used for military

purposes. Production of the famous "beetle" began in

the late 1940s. Cumulative production reached one million units

in 1955, 10 million in 1965 and 50 million in 1986. The first

foreign subsidiaries were set up in South Africa in 1946, Canada

in 1952, Brazil in 1953 and the US in 1955. In 1960 60% of the

company's capital held in trust by the government was sold to the

public, while 20% each remained with the Federal Government and

the Government of Lower Saxony. Dividends accruing to these two

parties are paid to the VW Foundation .

In the year 1983 an agreement on technical collaboration was

concluded with Nissan Motor CO in Tokyo, under which Nissan would

build VW's medium-range Santana in Japan, while 1986 saw the

emergence of Shanghai-Volkswagen Automotive Co Ltd to assemble

the same model in China. Also in 1986 VW took over the Spanish

manufacturer SEAT, which had been building VW models under a

co-operation agreement since 1983. This led to production

expansion, as a result of the globalisation, and established the

group as the fourth largest passenger automobile manufacturer in

the world.

In the West European market, the Group attains a competitive

advantage due to its custo-mer's brand loyalty, which has helped

them to become one of the market leaders.

In 1997 the Volkswagen Group spent approximately 4,4 billion DM on research and development. The Group focuses on the passive vehicle safety, the use of future oriented materials such as magnesium and improved plastics, as well as alternative drive technologies such as electric and hybrid drive systems. The number of the Group employees working in the R&D department increased by 4.2 % to 14,795 in 1996.

Table 5.3: Key figures for VW in

1997

Source: VW annual report

For VW, the German market is very important, as it counts for

nearly half its European sales, but sales in Germany have dropped

in the last few years.

In the future, VW Group will pursue its aggressive,

customer/oriented model policy in all market segments and niches,

as well as energetically advancing its brand strategy. The Group

will also maintain their globalisation strategy in order to

increase its operations in Eastern Europe. As mentioned in

chapter 4 the VW group has an extensive collection of new models

that will be introduced within the next 5 years.

FORD MOTOR COMPANY

Products

Ford manufactures passenger cars world wide in various price

ranges and styles, from European mini-cars such as the Fiesta to

American full-sized sedans, as well as light to heavy trucks,

related parts and accessories. Automotive operations outside the

US are conducted by a number of consolidated subsidiaries, the

largest in Germany, the UK, Ca-nada, Spain, Australia, Taiwan and

Mexico. In 1990 Ford produced almost 6 million cars and trucks

worldwide .

Fords financial service group consists of First Nation-wide

Financial Corporation, United States Leasing International Inc.,

Associates First Capital Corporation, Ford Motor Credit Company

and The American Road Insurance Company .

Background and Current Situation

Henry Ford established the company in 1903. Ford is the worlds

largest producer of trucks and second largest producer of cars

and trucks combined. Ford also engages in automotive related

business, such as financing and renting vehicles and production

of automotive components and systems.

The company's two principal business segments are Automotive and

Financial Services. The activities of the automotive segment

consist of the design, manufacture, assembly and sale of cars and

trucks and related parts and accessories. Substantially all of

Fords auto-motive products are marketed through retail

dealerships, most of which are privately owned and financed. The

primary activities of the Financial Services segment consist of

financing operations, vehicle and equipment leasing and rental

operations. These activities are conducted primarily through the

company's subsidiaries, Ford Motor Credit Company and The Hertz

Corporation

Table 5.4: Key figures for Ford in

1997

Source: Ford annual report

Europe is the largest market for the sale of Ford cars and

trucks outside the United States. Great Britain and Germany are

the most important markets within Europe, although the South

European countries are becoming increasingly significant. Any

adverse change in the British or German Market has a significant

effect on total automotive profits. Because of Ford's American

heritage, it was one of the first manufactures to treat Western

Europe as one market rather than separate countries, and has had

a presence in Europe almost as long as in North America. Ford

became the European leader by the 1980's, and in 1992 Ford had to

concede its position to GM and for one year only to Volkswagen.

The Ford share of all West European markets is remarkably even -

close to 10% in most countries. The exception is the UK market

with a market share of 20% and Greece with only 5%. Of the five

largest European markets, Ford's weakest position is in France,

and even there it has just below 8% of the market.

Having built up its market share from about 15% to over 30% at

the high point, Ford has now been losing market share steadily

for some years, as a consequence of opening the European markets

to competition. A situation in which the market leader often

suffers the largest fall.

Ford's model programs are now being developed on a global basis,

with USA specialising in large cars and the European operations

concentrating on medium and small car devel-opment. In theory

this seems to be sensible, but it may make the company less

flexible at a time when flexibility is the order of the day. Ford

already takes a long time to develop new models and it needs to

speed up this process considerably in order to respond to the

market (see section 4.3).

FIAT GROUP

Products

Passenger cars and vans are produced under the Fiat, Alfa Romeo,

Lancia-Autobianchi, Innocenti and Ferrari names. The company also

produces spare parts and accessories for cars. Recent strategy

has been to counter falling car sales worldwide by offering an

incre-ased range of high-performance and specialist cars.

In the commercial vehicles segment Fiat is represented by the

Dutch company Iveco NV, along with affiliates and licensees such

as TAM in Yugoslavia, Ashok Leyland in India and Oyotol and

Otasan in Turkey, which produce trucks, quarry and construction

vehicles, buses, fire engines, diesel engines and forklift

trucks.

Further Fiat produces farm and construction equipment as well as

metallurgical products.

Background and Current Situation

The Fiat company was set up in 1899 by a group of Turin notables

and by 1920 was alre-ady a fully integrated motor manufacturing

group. The policy of the group was to produce whatever was not

readily available in the Italian market. Between the Wars the

group ex-panded its activities to commercial vehicles, aircraft

production and rolling stock.

In the early 80's the group began to expand overseas, by

acquiring Iveco in Brazil in 1982. Home in Italy Fiat acquired

100% of Alfa Romeo in 1986. In the same year they entered a joint

venture with Ford of Britain and Iveco for the manufacture and

sale of heavy trucks in the UK. In 1987 Fiat made an agreement

for production in Poland of the groups new "micro"

vehicle .

Like most of the other actors in the industry, Fiat suffered

heavily in the early 90's. However since 1993 the Fiat Group has

recovered well, helped by two innovative new models, the Punto

and the Brave/Bravo.

At present Fiat has a market share just above 10% of the west

European market. Like the other volume car producers it produces

models in all the main market segments but it is constrained

somewhat by its two sister companies, Alfa Romeo and Lancia.

Although these two compete with Fiat, mainly in the upper market

segments, they are relatively weak outside Italy .

Fiat attempts to distinguish itself from its competitors by

offering cars that are a little bit different with a hint of

panache, but close enough to the norm to appeal to a wide market.

Italy accounts for almost half of the company's sales, while the

major EU markets Ger-many, France and the UK only accounts for

34% of Fiat's European sales. The sales in the Italian market

have been down in previous years, so Fiat is acting to reduce

this depen-dence on its home market.

The company is relatively weak in Scandinavia, but it does not

hold a strong market posi-tion in any country outside Italy apart

from Portugal and Greece. The reason for the we-akness in

northern Europe could be the company model profile, which

emphasises small cars, while in Northern Europe there is a marked

preference for larger cars.

Fiat's share of the market will decline as the Punto and the

Brave pass their model peaks. In the longer term it is vulnerable

to an opening up of the Italian market which at present is still

the most protected in Europe. The most urgent priority for Fiat

is to establish a rea-listic marketing strategy and to develop

sales outside Italy, especially in Northern Europe.

PSA (PEUGEOT SA)

Products

Automobiles Peugeot manufactures a wide range of cars from the

106 minicar to the executive-class 605, including saloons,

hatchbacks and estate cars, both two- and four-wheel drive, with

petrol, diesel and turbo-diesel engines, as well as commercial

vehicles powered by petrol, diesel and electricity. It has plants

in France, Spain and the UK. The group also includes Automobiles

CitroŽn, with models ranging from the small AX hatchback to the

executive-class XM, as well as commercial vehicles. CitroŽn

manufactures in France, Spain and Portugal. Unit sales for the

PSA Group totalled approximately 1,5 million passenger cars 1996.

The PSA group also includes its Mechani-cal engineering service

and financial services.

Table 5.6: PSA Europe

Source: Neil Mullinieux, The new car

market in Europe; p. 7

Background and Current situation

The present company was formed in 1976 to merge two

long-established French car pro-ducers. Peugeot dates back to the

Peugeot family business in Montbeliard where bicycle and tricycle

production was followed by automobile production in the early

1890's. In the1920's the company began producing its first

complete model range, the 01 series, followed by the 02 in the

1930's and the 03 in the late 1940's. The 04 in the 1960's and

the 05 in the 1977 and the 106 launched in 1991.

After World War II Peugeot began expanding abroad. The largest

production facility was set up in Argentina, while a large number

of assembly operations started in Africa, Southeast Asia,

Australia, New Zealand, Spain and Portugal.

CitroŽn also originated as a family business. The company was

initiated by Andre CitroŽn in 1924 and grew to be the third

largest car producer in France. The largest subsidiary was set up

in Spain as well as important operations in Argentina, Belgium

and Eastern Europe.

In 1974 Peugeot and CitroŽn decided to co-operate at the

instigation of the French government, which was intent on

rationalising the French automobile industry. This led to Peugeot

taking over CitroŽn in 1975 .

In 1988 Peugeot, Suzuki of Japan and Austin Rover formed Peugeot

cars in Japan. PSA became the world's leading manufacturer of

diesel engines in 1988 and launched a wide range of new

diesel-engine versions of Peugeot 405 and CitroŽn BX.

In 1990 PSA teamed up with RZB Austria to establish an Austrian

bank to offer finance to dealers and customers, and a dealer

network of over 230 outlets for Peugeot and Ci-troŽn combined

was built in East Germany. CitroŽn Japan was set up in

partnership with Mazda and Seibu to build sales in Japan, and

Automobiles Peugeot increased it stake in Peugeot Japan to 67%.

In December of the same year CitroŽn signed a joint venture with

China's Second Automobile Works for production of the ZX model in

China .

Peugeot shares design and engineering resources with CitroŽn but

keeps its sales and mar-keting operations distinct. The Peugeot

product is aimed more at mass market than Ci-troŽn. The

engineering is more conservative and the design is aimed at the

average moto-rist. Despite this clear differentiation between the

two companies, the group as a whole has gradually lost market

share in recent years, particularly Peugeot. CitroŽn, although

the smaller of the companies, has managed to retain its market

share. One of the reasons for this is that both companies are

heavily dependent on their home market.

Today PSA is Europe's third largest car manufacturer, and

Europe's leading manufacturer of light commercial vehicles. In

addition to its two core car manufacturers, Automobiles Peugeot

and Automobiles CitroŽn, PSA also active in a number of

businesses strategically related to the automobile industry.

In 1996, PSA intensified its three-pronged strategy of, 1)

updating and enhancing two comprehensive lines of products and

services that respond to customer expectations. 2) accelerating

cost-reduction programs, and 3) pursuing international expansion

while maintaining margin integrity. As part of this strategy,

several new models will be introdu-ced during the next years .

Table 5.7: Key figures for PSA in

1996

Source: PSA annual report

Today PSA is Europe's third largest car manufacturer, and

Europe's leading manufacturer of light commercial vehicles. In

addition to its two core car manufacturers, Automobiles Peugeot

and Automobiles CitroŽn, PSA also active in a number of

businesses strategically related to the automobile industry.

In 1996, PSA intensified its three-pronged strategy of, 1)

updating and enhancing two comprehensive lines of products and

services that respond to customer expectations. 2) accelerating

cost-reduction programs, and 3) pursuing international expansion

while maintaining margin integrity. As part of this strategy,

several new models will be introdu-ced during the next years .

GENERAL MOTORS CORPORATION (GM)

Products

GM's automotive department consist of the manufacture, assembly

and sale of automobi-les, trucks, buses and related parts and

accessories. In 1990 GM held just over 35% of both the US car and

light truck market, with worldwide sales of 7,451,000 units.

Product lines include Saturn, Chevrolet, Pontiac, Oldsmobile,

Buick, Cadillac and GMC Trucks in the domestic market, Opel in

continental Europe and Vauxhall in the UK.

Further GM has a number of finance and insurance activities.

These activities are carried on by GMAC (General Motors

Acceptance Corporation) and its subsidiaries, as well as by other

subsidiaries of General Motors .

Background and current situation

William C. Durant formed general Motors in 1908, to

take over the assets of the failing Buick Motor Company,

Oldsmobile as well as the Oakland and Cadillac companies. From

the beginning the company's strategy was three-pronged: 1) to

produce a variety of cars to suit a variety of tastes and

purchasing powers 2) to diversify as widely as possible in

automotive engineering 3) and to integrate backwards into the

manufacture of compo-nents .

In 1983 GM entered an agreement with Toyota for the production of

a small Chevrolet. GM Fanuc Robotics Corp, a joint venture

between GM and its subsidiary GM Hughes Electronics, set up in

1982, is the largest manufacturer of robots in the US. GM also

has joint ventures with Daewoo and Isuzu.

In mid-1986 the company began a programme of cost-cutting, staff

reduction and capacity maximisation in an effort to enhance

competitiveness in the face of increasingly sophisti-cated

Japanese imports . One aim was for fewer and better model lines.

1987 and 1988 marked a period when a large number of new models

was introduced, again to try to im-prove GM's competitive

position.

As the world's largest carmaker General Motors had long resented

its secondary position in the European market, and it finally

achieved market leadership in 1992 and then con-solidated its

position. GM has been present in Europe since early this century,

and as an American manufacturer it has not concentrated on a

single domestic market, but has de-veloped a good spread across

the continent. However, it does have a particular sales

con-centration in Germany and UK, which accounts for over 55% of

the company's European Sales. The other large markets, France,

Italy and Spain, also play a significant part in total sales. GM

is also the market leader in Netherlands and Switzerland. The

weakest market is Sweden where it commands only 6.7% of the

market.

Table5.8: Key figures for GM in 1996

Source: GM annual report

GM's design policy is flexible, as it does not centralise its

model designs worldwide. Each region will take responsibility for

its major models, though there are far more collaborati-on than

earlier, in order to make use of common parts .

BMW (BAYERISCHE MOTOREN WERKE) GROUP

Products

The BMW range of cars consists of the 3 Series medium-sized and

two-and four-door saloons and estate cars, the 7 Series luxury

saloons and long-wheelbase saloons, the 8 Series coupes and the

Z1 sports car. Cars are also produced under the Rover name. The

division also includes the BMW Motoren GmbH engine plant in

Austria that, together with BMW Austria GmbH, makes BMW one of

the 10 largest industrial companies in Austria. BMW Motorsport

GmbH is involved in motor sport with cars based on existing

models, as well as developing and producing the high-performance

cars and engines of the M series. BMW Technik GmbH is an

independent subsidiary developing system solu-tions in all fields

of automotive engineering, including component and prototype

devel-opment . Further the BMW Group produces motorcycle

products.

BMW was founded in 1916 as Bayerische Flugzeugwerke AG to make

aircraft engines. The company begun producing motorcycles in 1923

and became a leader in this field by the 1930's. In the late

1920's, BMW acquired a license for air-cooled aircraft engines

from Pratt & Whitney, and a car factory in Eisenach. In the

early 1950's, BMW started car production, making the first

eight-cylinder car and mini-cars. Car production developed

steadily to eclipse motor bikes and aircraft engines, which it

stopped making in 1965. In 1967, BMW took over Hans Glas GmbH, a

maker of mini-cars. Since then, the company has steadily

increased the size of its cars and now all its models are in the

medium and full-size range. Export is highly important for the

company, as 63% of sales are outside Europe. Thus subsidiary

companies are established in 14 of the most important foreign

markets

Table 5.9: Key figures for BMW in 1996

Source: PSA annual report

BMW is one of the few western car producers to have realised

profits consistently over the past two decades. In spite of this

long period of success in car and motorcycle manu-facture, BMW

entered a period of development in 1990. After 26 years out of

the aircraft engine business, BMW and Rolls Royce set up BMW

Rolls Royce GmbH, a 50.5/49.5 joint venture, in July 1990 .

Today BMW has evolved into one of the most admired companies in

the Industry. While Mercedes-Benz is perceived as a provider of

prestige transport for chairmen and ambas-sadors, BMW has carved

out a reputation for slightly smaller but more interesting

ve-hicles. Cars for the up-and-coming executive, rather than for

the one that has already arri-ved .

BMW sells many of its cars in the German Market, but it has a

good sales distribution over all European markets. In terms of

size, the UK is the second largest market, followed by France and

Italy. In terms of Market share BMW is strongest in Germany with

6.5% of the market, followed by Luxembourg, Belgium and

Switzerland. It is weak in some of the Nordic countries, but it

has least a 1 percent share in every European Mar-ket.

RENAULT

The French State has owned Renault for many years, and although

it is now privatised, it is still expected by some to act as an

arm of the state. Renault is a larger manufacturer than Peugeot

or CitroŽn individually and it has shown innovative flair over

the years by producing vehicle concepts and it has led model

trends within the industry.

The company controls a 10% share of the European market, which is

a decline in recent years but the same as in 1990. However, in

1996 its sales only grew by 3.5%, much lower than the market

growth. As the French market, where Renault is the market leader,

grew by 10%, this was a very disappointing performance. France

accounts for 45% of Re-nault's sales in Europe.

The company has a substantial presence in Germany, as it is its

next largest market. In both Italy and the UK, Renault has a 6%

market share.

The company has attempted to shift towards larger, higher margin

cars. Despite of this, Renault faces a number of difficulties in

the next decade, particularly its reliance on the French market

and its high cost base. As the influence of the French government

wanes it will become much more its own master, and it will

probably explore ways of co-operating with other manufacturers.

It has already had discussions with Skoda, Chrysler and Volvo, so

it is making no secret of its desire for alliances .

If it cannot find a partner, its best strategy would be to build

on its design strengths and introduce niche models derived from

its mainstream products.

SECTION SUMMARY

In this chapter we have briefly described the seven largest

actors in the European market, with respect to products, history

and current situation. The market actors will be used again in

the next section, when discussing strategic groups and

segmentation.