The European Automotive Industry

Problem Statement

PROBLEM DESCRIPTION

This project focuses mainly on the level and nature of

competition in the car industry. Especially we are concerned with

the market power of car manufacturers. Market power is closely

related to the slope of the demand curve, which determines the

discretion a company has over its prices. The reason for this is

that in competitive industries, substitution within the industry

is more likely. Thus companies cannot charge prices significantly

above its competitors prices. This leads to elastic demand.

Firms with monopoly power face a downward-sloping demand curve,

which means that to sell an extra car the manufacturer must lower

the price on all cars produced (Disregarding the ability to price

discriminate). Thus the marginal revenue of selling an additional

unit will always be below the price of that unit. The firm will

produce at the level where marginal costs equal marginal revenue.

Since marginal revenue is always below price, the firm will gain

monopoly rents.

Besides these static effects of competition vs. monopoly power

there are also dynamic effects of competition. A major concern

for many policymakers is the effect of the automotive industry on

the environment. In this respect the combination of government

policy and competition in the car industry, might provide a

powerful incentive for invention of more environmental vehicles

in the industry. E.g. if government increase taxes on fuel, the

competitive industry will adjust and provide cars with better

fuel economy, whereas the manufacturer with high monopoly power

can more easily pass taxes on to consumers.

As mentioned the objective of this report is to describe the

nature and level of competition in the European car industry.

This is of great importance both to government and to individual

producers, as the level of competition is closely linked to both

economic efficiency and industry profitability. A clear

perception of the industry drivers are also important for the

manufacturers, both in order to make rational decisions, but also

in order to understand the strategic interactions with

competitors.

PROBLEM DEFINITION

Thus the main focus of this report is on describing the factors

that influence the industry and the corporations within it with

the purpose of:

Identifying and describing the most important market structures

and drivers of the industry, and determining the effect these

structure have on the conduct of corporations in the industry.

Further we will discuss how the above affects the level of

competition in the industry.

It should be stressed that we do not assume that the relationship

between structure and conduct is unilateral, and thus conduct may

affect structure as well.

We will also examine how market structure and the industry

drivers are likely to change over time, and how this will affect

the conduct of car manufacturers and performance of the industry.

In order to answer this question and the ones mentioned above we

need to examine the following subquestions:

# What are the main features of the industry?

# How does these features affect the level of competition in the

industry?

# Who are the main actors in the industry, and what are their

distinctive features?

# Are there strategic groups in

the industry?

# How are the industry drivers likely to change over time?

# How does that affect the industry?

As mentioned this is a rather

complex subject, and therefore a rigid structure is needed for

the report. This structure is described below, together with a

section regarding the methodology used and a section on the

limitations of our investigation of the European car industry.

STRUCTURE OF THE REPORT

After the introduction and preliminary considerations, we will

move on to a discussion of industry features. Here we will

present facts about the industry, and discuss their effects on

competition and conduct of market actors.

Next we move on to discuss the factors that determine long run

competitiveness in the industry in chapter 4.

Thereafter we will describe the major car manufacturers in the

European market, with respect to product lines, brands, market

share, presence in different European markets etc. We have chosen

to concentrate on the following manufacturers: Volkswagen-Audi,

General Motors Europe, PSA, Renault, Fiat, BMW, and Ford Europe

since they are the 7 largest manufacturers in the European

market.

Next we will divide the market into segments, and the actors into

strategic groups. Further we shall combine the two, by using the

diversification across segments as a criteria for strategic

groups.

In chapter 7 we will conduct an analysis of the financial

statements of these companies. Here we will focus on vertical

integration, cost structures and R&D. The purpose is to

quantify some of the factors discussed in the preceding chapters.

Thus this is not a traditional cash flow oriented analysis, with

the intent of evaluating company performance.

Next we turn to the future of the industry. Here we will discuss

how some of the basic industry drivers are likely to change in

the future and how this will affect the structure and conduct in

the industry.

Finally we will write a conclusion summing up our findings in the

previous sections. In addition to this each of the chapters will

finish with a section summary summing up the findings in that

chapter.

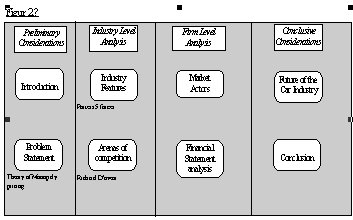

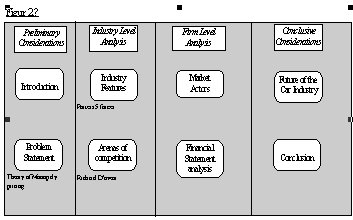

Thus the report is divided into four major parts. The preliminary

considerations contain the introduction and the problem

statement, whereas the chapters 3 and 4 concerning level and

nature of competition will conduct an analysis at the industry

level. The firm level analysis will contain the chapters on

market actors and financial statements. The future of the car

industry and the conclusion make up the conclusive

considerations.

This division and the general structure of the report are

illustrated in the figure below.

METHODOLOGY

The underlying paradigm of the report is a standard structure -

conduct - performance paradigm, like the one described in the

figure below. The paradigm consist of basic structures (Nature of

supply and demand), market structure, conduct of market actors

and performance of the industry .

In its simplest form this paradigm suggests, that there is a

causal relationship between the basic conditions and the market

performance. However, as shown in figure 2.2 this is not always

so. For example it is possible, that conduct of large market

actors can affect the structure of the industry through mergers

or acquisitions.

It is not the intent of this report, to make a complete analysis

along the paradigm. Such an analysis is beyond the scope of this

report, both with respect to size and available information.

As indicated earlier we will

merely focus, on how the basic structures concerning the car

industry affects the level of competition, and determine the

factors that drive the industry.

In order to describe the industry we will use a modified Porters

5 forces, with emphasis on the factors we consider most relevant

to the automotive industry. This theory has been chosen, as it is

traditionally a model used for discussing industry competition.

It does not provide answers or conclusions, but gives the section

on industry features a firm structure. The model is based on the

structure-conduct-performance paradigm, and thus assumes that

competition is dependent on industry features. As mentioned above

we modified the model slightly, in order to focus on specific

aspects that are especially relevant to this report. These

modifications are described in the beginning of chapter 3. To

make up for the model's lack of conclusive determination, we

shall use other theories for the individual issues of Porters

model. These are concentration measures (HHI and CR4), theory of

market power, game theory, transaction cost theory and theory of

price discrimination. These are briefly described in relevant

sections.

In order to describe the nature of competition we shall use

Richard D'Avenis theory of hypercompetition and arenas of

competition, as presented in the article "Hypercompetition:

Managing the dynamics of strategic maneuvering". The basic

content of the theory is presented in the beginning of chapter 4.

The reason for choosing this model is its long run focus. D'Aveni

believes that over time all competitive advantages are eroded.

This naturally puts an emphasis on the factors that contribute to

competitiveness in the longer term.

For the discussion of the industry future, we shall use some of

the same theories as in chapter 3, since we in this chapter focus

on how some single factors are likely to change in the future,

and how this affects the level and nature of competition. Thus we

merely apply the same theories, but under different

circumstances. An exception is the theory of economies of scale,

which is used to analyse the causes of increased industry

concentration.

Textbooks used for background information on applied theories,

are not referred to in the text, but are stated in the list of

sources.

The report is based on public information. Thus we will not

conduct a thorough investigation of the industry actors or the

structure of the industry, but rather rely on the work of others.

The main source of information is books from the Economist

Intelligence Unit, that provide statistical facts of the industry

like unit sales in different segments, sales in different

countries, etc. Further we shall use facts on prices in different

national markets.

Where available we shall also use the annual reports of market

actors.

The individual theories that we use in each section can be seen

in figure 2.2 above. When necessary these theories are presented

and discussed in the relevant chapters.

LIMITATION

There are a number of limitations to this report, with respect to

available information and scope.

We have chosen to focus only on the European car industry, and

thus we will not discuss Japanese competitors in detail, although

these firms contribute to the level of competition in the

industry.

Further we shall focus only on the market for new passenger cars.

Thus we shall not discuss used cars or commercial vehicles. This

leads to some difficulties with respect to available information,

since annual reports often do not separate passenger cars from

commercial vehicles.

As mentioned above, we will not discuss short-term competitive

advantage in chapter 4. The reason is that examining all the

factors that contribute to competitive advantage is beyond the

scope of this report. Instead we shall only discuss the long-term

factors, that may help to build a series of short term

advantages.

For the financial statement analysis, there are a number of

limitations, with the respect to applying financial data. This is

discussed in the relevant chapter. Unfortunately it has not been

possible to obtain annual reports for Renault and Fiat.