Chapter 10 : Financial

Futures Market

(a) Future contract

Agreement that require

a party to the agreement either to buy or sell something at a designated

future date (settlement

Agreement that require

a party to the agreement either to buy or sell something at a designated

future date (settlement

or delivery

date) at a predetermined price (future price)

(b) Basic Economic function

hedge against the

risk of adverse price movement (price change protection)

hedge against the

risk of adverse price movement (price change protection)

(c) Futures contracts

products created

by exchanges

products created

by exchanges

(d) Commodity Futures Trading Commission (CFTC) --- approve contract

(e) Prior 1972, commodity futures only

(f) Financial Futures

Stock index futures

Stock index futures

Interest rate futures

Interest rate futures

currency futures

currency futures

(g) Chicago Mercantile Exchange (CME) --- 2nd largest, create financial

futures, currency futures (7 currencies in International

Monetary Market (IMM)) in 1972

(h) Chicago Board of Trade (CBOT) --- established in 1848 by 82 merchants

(oldest and largest future exchange in the world)

(i) CFTC (regular trade agency) --- similar to SEC, established by

Congress with the headquarters in Washington D.C

(j) NFA (National Futures Association) --- The association related

to futures market

I

Mechanics of Futures Trading

1. Liquidating a position --- settlement date : March, June, September,

December (every 3 months)

2 choices

2 choices

(a) liquidate prior to the

settlement date --- take on offsetting position in the same contract (close

out), no actual delivery,

more popular

(b) wait until the settlement

date (actual delivery), only 4% or less

2. Role of clearing house

every future exchange

is associated with clearing house. For example: CBOT with BOTCC (Board

of Trade Clearing

every future exchange

is associated with clearing house. For example: CBOT with BOTCC (Board

of Trade Clearing

Corporation)

(a) Guaranteeing that the 2 parties

to the transaction with perform (after initial execution of an order, take

over the role of

the other party)

(b) make it simple to unwind positions

prior to settlement date

3. Margin requirement --- Financial guarantee

investor must deposit

a minimum amount of money as specified by exchange (initial margin) ---

broker firm charge higher

investor must deposit

a minimum amount of money as specified by exchange (initial margin) ---

broker firm charge higher

small fraction of

price of futures contract to enjoy the leverage

small fraction of

price of futures contract to enjoy the leverage

margin : good faith

money (marking to the market --- everyday update)

margin : good faith

money (marking to the market --- everyday update)

maintenance margin

maintenance margin

If the futures is

up today, the amount of money will be deposit into the account and vice

versa, check every day after

If the futures is

up today, the amount of money will be deposit into the account and vice

versa, check every day after

closing

4. Market Structure

Price is determined

by open outcry of bid and offer in an auction market

Price is determined

by open outcry of bid and offer in an auction market

membership: seat

(CBOT 3600 seats with 1402 are full membership approximately $500,000 each)

(CME 2725 seats

membership: seat

(CBOT 3600 seats with 1402 are full membership approximately $500,000 each)

(CME 2725 seats

with 625 are full membership

approximately $625,000 each)

pit --- no specialist

pit --- no specialist

full membership ---

can trade any future exchange

full membership ---

can trade any future exchange

Floor trader

Floor trader

(a) locals : buy and sell

futures for their own account (market makers)

(b) floor broker : execute

customer orders (main job) and for their own account

5. Daily price limit

provide stability

to the market

provide stability

to the market

II

Futures vs. Forwards

| Fowards |

Futures |

Non-standardized (term

are negotiated) Non-standardized (term

are negotiated)

OTC Market between investors OTC Market between investors |

Standardized (delivery

date, quality, location for delivery) Standardized (delivery

date, quality, location for delivery) |

No clearing house (more

credit risk, no exchange, no margin) No clearing house (more

credit risk, no exchange, no margin) |

Clearing house (Credit

risk is minimal, exchanged, 95% are liquidate prior to settlement date) Clearing house (Credit

risk is minimal, exchanged, 95% are liquidate prior to settlement date) |

OTC Instrument OTC Instrument |

Traded on Organized Exchanges Traded on Organized Exchanges |

Intended for delivery Intended for delivery |

Not intended to be settle

by Delivery Not intended to be settle

by Delivery |

Single Payment at Maturity Single Payment at Maturity |

Marked to Market (Daily

Settlement) Marked to Market (Daily

Settlement) |

Financial Institutions

and Corporations Financial Institutions

and Corporations |

|

III

Risk and return characteristics

Long position : buy a future

contract

Long position : buy a future

contract

Short position : sell a

future contract

Short position : sell a

future contract

Buyer : realize profit

if the future price increase

Buyer : realize profit

if the future price increase

Seller : realize profit

if the future price decrease

Seller : realize profit

if the future price decrease

For example : today, S&P 500 buy at $1000. Mature in September 20th,

actual price is $1200. Profit will be $200 X 500 = 100,000

IV

Pricing of Futures Contract

1. Theoretical Price

F = P + P(r-y)

where F : futures price (forward) --- complicated because market to

market

P : cash market

price (current price)

r : financing

cost

y : convenience

yield (cash yield) --- yield from holding the asset

*** (r-y) : cost of carry (net financing cost)

| Carry |

Future Price |

| r > y |

F > P |

| r < y |

F < P |

| r = y |

F = P |

2. Price convergence at the delivery date

at the delivery date

the futures price must be equal to the cash market price

at the delivery date

the futures price must be equal to the cash market price

law of one price

? can enjoy arbitrage

law of one price

? can enjoy arbitrage

V

General principles of hedging with futures

major function of futures

market

major function of futures

market

-- transfer price risk from hedgers to speculators

Hedge

Hedge

-- strategy used to offset investment risk

-- A perfect hedge is one elimination the possibility

of future gain or loss (perfectly negatively correlated)

-- locks in a value for the cash position

hedger : less risk because

move risk

hedger : less risk because

move risk

speculator : without speculator,

the market will not exist, more aggressive because just want to make profit,

depends on

speculator : without speculator,

the market will not exist, more aggressive because just want to make profit,

depends on

own expectation to make profit, never enjoy

in delivery

1. Risk associated with hedging

(a) choice

the choice of the

asset underlying the future contract

the choice of the

asset underlying the future contract

choice of the delivery

month

choice of the delivery

month

(b) Basis risk

basis : spot price,

future prices

basis : spot price,

future prices

if the asset for

hedge, and future construct are the same, the basis should be zero at maturity

at the contract

if the asset for

hedge, and future construct are the same, the basis should be zero at maturity

at the contract

there is risk if

the hedge maturity is different from future maturity

there is risk if

the hedge maturity is different from future maturity

(c) Cross-hedge risk

there is risk if

asset for hedge and futures contract are different

there is risk if

asset for hedge and futures contract are different

price movement of

the underlying instrument of futures contract may not accurately tract

the price movement of the

price movement of

the underlying instrument of futures contract may not accurately tract

the price movement of the

asset for hedge (example : IBM stocks vs. S&P 500)

VI

Role of Futures in Financial Market

provide another market

(alter risk)

provide another market

(alter risk)

lower transaction cost

lower transaction cost

faster execution

faster execution

substantial leverage

substantial leverage

Long hedge and short hedge ***

1. Long hedge --- buy hedge (already have underlying asset)

to protect against increase in the price of a financial instrument

to protect against increase in the price of a financial instrument

example : Jewelry company

example : Jewelry company

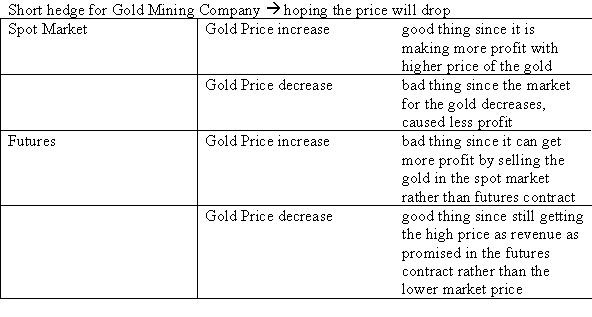

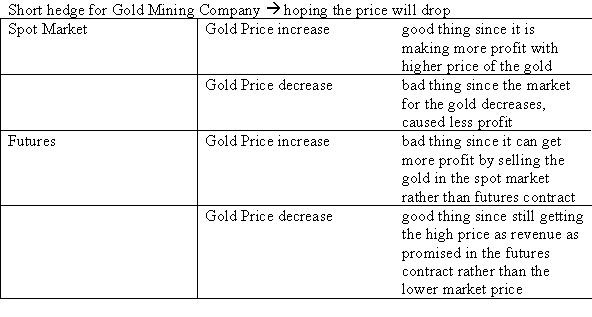

2. Short hedge --- sell hedge

to protect against decline in the future cash price of a financial instrument

to protect against decline in the future cash price of a financial instrument

example : gold mining company

example : gold mining company