Secondary Market

Stock Exchange

I

Secondary Market

Stock Exchange

![]() formal organization

formal organization

![]() approved and regulated

by SEC

approved and regulated

by SEC

![]() listed stocks --

stocks that are traded in an exchange

listed stocks --

stocks that are traded in an exchange

![]() since August 1976, listing

of a common stock on more than one exchange permitted (dual listing is

OK)

since August 1976, listing

of a common stock on more than one exchange permitted (dual listing is

OK)

![]() seat -- member of

Exchange (example : NYSE had 1366 seats with the latest price for the seat

is $2 Million in March)

seat -- member of

Exchange (example : NYSE had 1366 seats with the latest price for the seat

is $2 Million in March)

![]() Each stock is traded at

a specific location -- Post

Each stock is traded at

a specific location -- Post

![]() Employee work in the first

floor and businessmen can watch it from second floor through big windows

Employee work in the first

floor and businessmen can watch it from second floor through big windows

![]() specialist -- market

maker (single market maker) vs. OTC (multiple market maker)

specialist -- market

maker (single market maker) vs. OTC (multiple market maker)

![]() traditional floor based

trading system

traditional floor based

trading system

![]() first market

first market

Major National Stock Exchanges

NYSE (Big board)

![]() largest exchange (equity)

in USA and world

largest exchange (equity)

in USA and world

![]() market capital : over 12

trillion

market capital : over 12

trillion

![]() establish in 1972

establish in 1972

![]() number of firms listed

3044

number of firms listed

3044

AMEX (American Stock Exchange)

![]() second largest national

stock exchange in New York, Manhattan

second largest national

stock exchange in New York, Manhattan

![]() small to medium size companies

small to medium size companies

![]() equities and derivatives

(options)

equities and derivatives

(options)

Regional Exchanges

![]() Midwest (Chicago), Pacific

(LA), Philadelphia, Boston, Cincinnati

Midwest (Chicago), Pacific

(LA), Philadelphia, Boston, Cincinnati

![]() 2 kind of stocks listed

2 kind of stocks listed

(i) stocks of companies that could not qualify for

listing on National Exchange

(ii) stocks of companies that are also listed or

one of the two National Exchanges (dual listing)

OTC (Over the Counter)

![]() market for unlisted stocks

market for unlisted stocks

![]() second market (Note NASDAQ

listed 5412 companies)

second market (Note NASDAQ

listed 5412 companies)

![]() stocks maybe both listed

on an exchange and traded in the OTC vs. Third Market

stocks maybe both listed

on an exchange and traded in the OTC vs. Third Market

![]() trading listed stocks in

the OTC market

trading listed stocks in

the OTC market

Dependent Electronic Trading Systems

![]() Fourth Market

Fourth Market

![]() Direct trading of stocks

between two transactors without the use of a broker

Direct trading of stocks

between two transactors without the use of a broker

![]() 2 major system

2 major system

(a) instinet (by Reuter in 1987)

(b) POSIT (portfolio system for institution investors)

Automated Order Routing

![]() Exchanges have systems

for routing orders of a specific size that are submitted by brokers via

computer directly to a

Exchanges have systems

for routing orders of a specific size that are submitted by brokers via

computer directly to a

specialist post

(a) NYSE

![]() Super DOT (Super Designated

Order turnaround)

Super DOT (Super Designated

Order turnaround)

![]() Largest market order :

30,099 shares

Largest market order :

30,099 shares

![]() ¾ of all orders

(10-20% or trading volume)

¾ of all orders

(10-20% or trading volume)

(b) AMEX

![]() Post Execution Reporting

System (up to 2000 shares)

Post Execution Reporting

System (up to 2000 shares)

Role of dealers

(a) Exchange : only one dealer per stock -- specialist

![]() exchange determine designation

of who will be a specialist for a stock

exchange determine designation

of who will be a specialist for a stock

![]() minimum capital requirement

is $1 Million

minimum capital requirement

is $1 Million

![]() Act as brokers and dealers

Act as brokers and dealers

![]() maintain current bid and

ask price

maintain current bid and

ask price

![]() buy or sell in their own

account

buy or sell in their own

account

![]() agent and catalyst

agent and catalyst

(b) OTC

![]() more than one dealer for

a stock (multiple dealer)

more than one dealer for

a stock (multiple dealer)

II

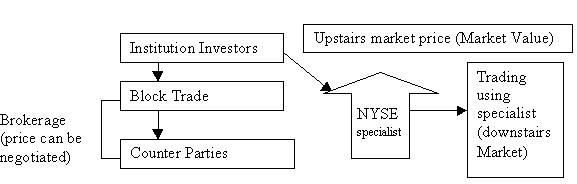

Trading Arrangements for Institutional Investors

1. Block Trade

2. Program Trade

Block Trade

Trade of a large member of shares of a given stocks (10,000 shares

or market value $200,000)

(a) Directed to the “upstairs market” where a block broker facilitates

the trading process by locating counter parties to the

trade

![]() The upstairs market operates

as a search-brokerage mechanism where prices are determine through negotiation

The upstairs market operates

as a search-brokerage mechanism where prices are determine through negotiation

(b) Downstairs market is the ability to prosecute immediate execution

of quoted price

Program Trade

![]() Trade for a large number

of different stocks simultaneously (basket trade)

Trade for a large number

of different stocks simultaneously (basket trade)

![]() wide range of portfolio

trading strategies involving purchase or sale of a basket of at least 15

stocks with total value of

wide range of portfolio

trading strategies involving purchase or sale of a basket of at least 15

stocks with total value of

$1 Million or more

![]() send order to

send order to

(a) downstairs market (exchange floor)

(b) upstairs market (network)

(c) OTC

III

Stock Market Indicators

![]() serve as benchmark

serve as benchmark

![]() most common indicator

most common indicator

(a) DJIA

(b) S & P 500

(c) Value Line Composite Average (VLCA)

![]() 3 factors differentiate

stock market indicator

3 factors differentiate

stock market indicator

(a) universe of stocks represented by the indicators

(b) relative weights assigned to the market

(c) method of averaging

Weighting system

Universe of Stocks

1. By exchange

![]() NYSE composite index --

all listed firms -- market capital

NYSE composite index --

all listed firms -- market capital

![]() AMEX market value index

AMEX market value index

![]() reflect market value of

all stocks traded on exchange

reflect market value of

all stocks traded on exchange

2. Subjectly selected stocks

![]() by organizations

by organizations

![]() popular indications fall

into this group

popular indications fall

into this group

![]() example DJIA : 30 of the

largest blue chip industrial companies traded on NYSE

example DJIA : 30 of the

largest blue chip industrial companies traded on NYSE

3. S&P 500

![]() 2 international stock exchange

and NASDAQ (Mostly NYSE)

2 international stock exchange

and NASDAQ (Mostly NYSE)

![]() benchmark for portfolio

managers’ performance

benchmark for portfolio

managers’ performance

![]() 80% of market value of

NYSE

80% of market value of

NYSE

![]() market value weighted

market value weighted

4. Value Line (VLCA)

![]() equally weighted geometric

average of approximately 1700 NYSE, AMEX OTC

equally weighted geometric

average of approximately 1700 NYSE, AMEX OTC

By Objective measuring (Market Capitalization)

example

![]() . Wilshire 5000 (Largest

is General Electric)

. Wilshire 5000 (Largest

is General Electric)

![]() Wilshire 4500 (excluding

S&P 500)

Wilshire 4500 (excluding

S&P 500)

![]() . Russell 3000 (Largest

is General Electric)

. Russell 3000 (Largest

is General Electric)

![]() Russell 1000 (the first

1000 largest market capitalization companies)

Russell 1000 (the first

1000 largest market capitalization companies)

![]() Russell 2000 (all Russell

listed companies except Russell 1000)

Russell 2000 (all Russell

listed companies except Russell 1000)

IV

1. Active Strategies

![]() attempt to outperform the

market

attempt to outperform the

market

![]() ways

ways

(a) timing the selection of transacting

(b) identify undervalue or overvalued stocks

(c) select stocks based on market anomaly (Monday,

January, small firm effects anomaly)

2. Passive Strategies

![]() if market efficient, with

respect to pricing stocks, attemptive outperform market, cannot be successful

systematically

if market efficient, with

respect to pricing stocks, attemptive outperform market, cannot be successful

systematically

![]() a portfolio characteristics

similar to market portfolio will capture the pricing efficiency of the

market

a portfolio characteristics

similar to market portfolio will capture the pricing efficiency of the

market

![]() indexing --

index fund ($55 billion invested)

indexing --

index fund ($55 billion invested)

example Vanguard’s and S&P 500 index fund

V

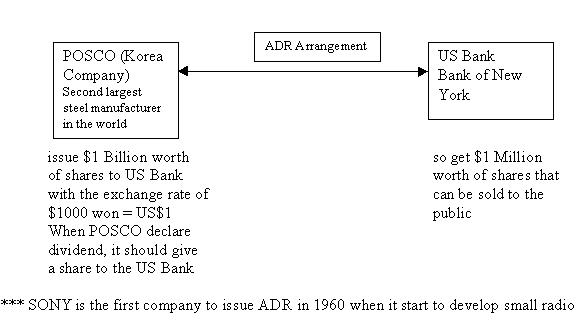

Non United State Equity Market

![]() shares of some foreign

companies can be traded through ADR (American Depository Receipts)

shares of some foreign

companies can be traded through ADR (American Depository Receipts)

![]() Issued by banks as evidence

of ownership of the underlying stock of a foreign corporation that the

United States banks hold

Issued by banks as evidence

of ownership of the underlying stock of a foreign corporation that the

United States banks hold

1. Euroequities (International Market)

![]() issued simultaneously in several national markets by an international syndicate

issued simultaneously in several national markets by an international syndicate

2. Motivation for listing on a foreign market

(a) increase visibility (awareness, name recognition,

exposure)

(b) broaden share holders base (diversify ownership)

(c) increase access to financial market

(d) provide future market for product

3. National Market Structure

(a) Stock exchange (privately owned)

![]() USA, Japan, United Kingdom, Canada, Australia

USA, Japan, United Kingdom, Canada, Australia

![]() essentially self regulated

essentially self regulated

(b) Stock exchange (public institute)

![]() government selects broker and fix commission rates

government selects broker and fix commission rates

![]() France, Spain, Italy

France, Spain, Italy

(c) Majority of trading (through banks)

![]() universal banks dominates securities transactions

universal banks dominates securities transactions

![]() Germany, Switzerland

Germany, Switzerland

4. Stock Market Indexes

(a) Japan Nikkei 225

(b) United Kingdom FTSE 100

(c) Germany DAX (Deutscher Aktienindex) --

30 most actively traded shares by Frankfurt Stock Exchange)

(d) France CAC 40 index (Paris Bourse)

(e) International equity Index (Morgan Stanley Capital

Market)

![]() MSCI EAFE -- more than 200 companies in 21 countries in Europe, Australia,

Far East

MSCI EAFE -- more than 200 companies in 21 countries in Europe, Australia,

Far East

5. Motivation for Global Investing

(a) diversification benefit

(b) International capital market : less than perfectly

correlated