Features of Debt Contract

I

Features of Debt Contract

![]() Fixed maturity

Fixed maturity

![]() Specified payment schedule

Specified payment schedule

![]() Fixed income obligations

paid before equity holder get paid

Fixed income obligations

paid before equity holder get paid

1. term to maturity

![]() number of years during which

the borrower has promised to meet the conditions of the debt

number of years during which

the borrower has promised to meet the conditions of the debt

2. Principal: the amount that will be repaid

3. Bullet maturity

![]() The entire

principal can be repaid at the maturity date

The entire

principal can be repaid at the maturity date

4. Balloon payment

![]() Various amount of

the principal can be paid over the life of the debt

Various amount of

the principal can be paid over the life of the debt

5. Par value (maturity value, face value)

![]() Amount paid at maturity

Amount paid at maturity

6. coupon: the periodic interest payment (United States every six months)

7. Zero coupon bonds (instrument)

![]() Deep discounted

Deep discounted

![]() Principal and interest paid

at maturity

Principal and interest paid

at maturity

8. Price of most debt contracts are quoted as percent of par value

![]() Example : par value

1000

Example : par value

1000

Price quote 91 ¾

%

Price in dollar 1000 X 0.9175 = $917.50

II

basic valuation principles

General formula measuring every securities with different interest

rate

|

a1

a2

an

nP0 = ----------- + ---------------- + ……………………….+ -------------------------------- (1 + r1) (1 + r1)(1 + r2) (1 + r1)(1 + r2)…..........(1 + rn) where a1 = cash flow

Price = the sum of present value (PV) of payments |

III

Return from a bond : YTM measure

How to compare the rate of return of instruments having different cash

flows (CFs) and different maturity?

-- YTM (Yield to Maturity)

Definition: the interest rate that makes the PV of CFs equal to

the market value (price) of the instrument

|

C1

C2

Cn

Price = ---------- + ---------- + ……………………………+ ----------------- (1 + y) (1 + y)2 (1 + y)n -- IRR (Internal Rate Return) earned from holding the bond to maturity Assumption

Weakness

|

IV

Reasons why a bond price will change

|

1. A change in the level of interest rate in the economy

![]() Example : if interest rate

increased, price decreased

Example : if interest rate

increased, price decreased

If interest rate decreased, price increased

![]() (negatively relationship)

(negatively relationship)

2. Price converges to par at maturity

![]() Overtime, price of discount

bond rises

Overtime, price of discount

bond rises

![]() Overtime, price of premium

bond declines

Overtime, price of premium

bond declines

3. For a non-treasuries

![]() Change in yield spread –

change in required yield

Change in yield spread –

change in required yield

![]() Risk premium also effect

the bond price

Risk premium also effect

the bond price

4. Change in the perceived credit quality at issue

IV

Premium par yield

If coupon rate > YTM -- sell at premium

(P > 100)

If coupon rate < YTM -- sell at discount

(P<100)

If coupon rate = YTM -- sell at par

(P = 100)

VI

Reinvestment of CFs and yield

-- risk associated with holding bonds

1. Interest rate risk (Price risk)

![]() The risk that a bond will

have to be sold at a lose if the bond is not hold to maturity

The risk that a bond will

have to be sold at a lose if the bond is not hold to maturity

![]() If the general level of

interest rate rises, the price of a bond falls

If the general level of

interest rate rises, the price of a bond falls

![]() i increased – price

decreased

i increased – price

decreased

![]() Negative relationship between

interest rate and price

Negative relationship between

interest rate and price

2. Reinvestment risk

![]() Future interest at which

the coupon can be reinvested will be less than the YTM – (Future i

< YTM)

Future interest at which

the coupon can be reinvested will be less than the YTM – (Future i

< YTM)

![]() (YTM assumption : all CFs

reinvested at YTM)

(YTM assumption : all CFs

reinvested at YTM)

![]() Interest on interest and

depends on the prevailing i level at the time of reinvestment

Interest on interest and

depends on the prevailing i level at the time of reinvestment

![]() higher interest rate is

good news for reinvestment

higher interest rate is

good news for reinvestment

![]() Note: zero coupon bond:

no investment risk

Note: zero coupon bond:

no investment risk

![]() i increased – price

increased

i increased – price

increased

![]() Positive relationship between

interest rate and price

Positive relationship between

interest rate and price

VII

Bond Price volatility

1. Review of Price / Yield

![]() Bond price changes in the

opposite direction from the change in yield

Bond price changes in the

opposite direction from the change in yield

|

non linear (not 450), asymmetric and convex |

2. Measure of Price volatility

![]() The price sensitivity of

a bond to a change in yield

The price sensitivity of

a bond to a change in yield

![]() Duration

Duration

Duration

(a) weighted average term to maturity to the components of a bond CFs

in which the time of receipt of each payment is

weighted by the PV of that payment

(b) weighted average term to maturity where the CFs are in term of

their PV

Properties of Duration

1. Coupon

![]() Bond with higher coupon

rate has a shorter duration (more weight is being given to coupon payment)

Bond with higher coupon

rate has a shorter duration (more weight is being given to coupon payment)

2. Duration of band < time to mature

3. Yield

![]() As market yield increased,

duration decreased (weighting of CFs will be more heavily placed on the

early CFs – duration

As market yield increased,

duration decreased (weighting of CFs will be more heavily placed on the

early CFs – duration

decreased)

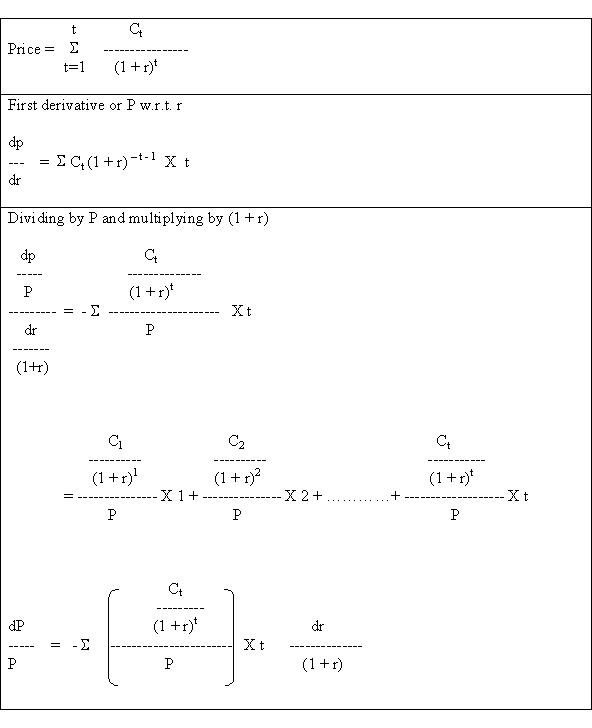

|

Definition

measure of the weighted average life of a bond (the approximately

percent change in price for small change in Y)

FACT

LT bond -- D decreased

coupon increased -- D decreased (more weighted to coupon)

yield increased -- D decreased

lower weight on CFs in the far future

Limitation

![]() local approximation

local approximation

![]() assume parallel shift in

Y.C

assume parallel shift in

Y.C