1950s only 2 super power that are Russia and United States. Russia had a lot of deposits in US banks. Take most US

dollars and deposit them in Europe banks which started Eurodollar

Money Market Instruments

![]() Treasury bills

Treasury bills

![]() Federal Funds

Federal Funds

![]() Repurchase Agreements

Repurchase Agreements

![]() Negotiable Certificates

of Deposit

Negotiable Certificates

of Deposit

![]() Commercial Paper

Commercial Paper

![]() Bankerís Acceptance

Bankerís Acceptance

![]() Eurodollar (Eurocurrency)

-- Russia

Eurodollar (Eurocurrency)

-- Russia

1950s only 2 super power that are Russia and United

States. Russia had a lot of deposits in US banks. Take most US

dollars and deposit them in Europe banks which

started Eurodollar

The Money Market

![]() They are usually sold in

large denominations (more than $100,000)

They are usually sold in

large denominations (more than $100,000)

![]() They have low default risk

They have low default risk

![]() They mature in one year

or less from their original issue date

They mature in one year

or less from their original issue date

Participants in the Money Market

![]() US Treasury Departments

(Seller) of T-bills

US Treasury Departments

(Seller) of T-bills

![]() Federal Reserve System

(Seller) buying and selling Treasuries

Federal Reserve System

(Seller) buying and selling Treasuries

![]() Commercial Banks (Seller)

Certificate of Deposits

Commercial Banks (Seller)

Certificate of Deposits

![]() Business (Buyer and Seller)

Commercial Paper

Business (Buyer and Seller)

Commercial Paper

![]() Investment and securities

firms (Buyer)

Investment and securities

firms (Buyer)

![]() Individuals (Buyer)

Individuals (Buyer)

Money Market

![]() Debt instruments that at

the time of issuance has a maturity of one year or less

Debt instruments that at

the time of issuance has a maturity of one year or less

![]() example : T-bills, CD,

MTN, FF, Bankersí Acceptance, CP, Repo

example : T-bills, CD,

MTN, FF, Bankersí Acceptance, CP, Repo

I

| T-bills | maturity one year or less |

| T notes | 2 years to 10 years |

| T bonds | more than 10 years to 30 years |

1. Bid and offer quote on T-bills

![]() quoted on a bank discount

basis (not on price basis)

quoted on a bank discount

basis (not on price basis)

![]() YD = D/F * 360/t

YD = D/F * 360/t

where D : dollar discount (difference between face value and the price)

where F : face value

where t : number of days remaining to maturity

![]() Example : 100 days to maturity

Example : 100 days to maturity

F : $100,000 selling for $97,367

D : 100,000 Ė 97367 = 2431

2431

360

YD = ------------ X ----------

100,000

100

= 8.75%

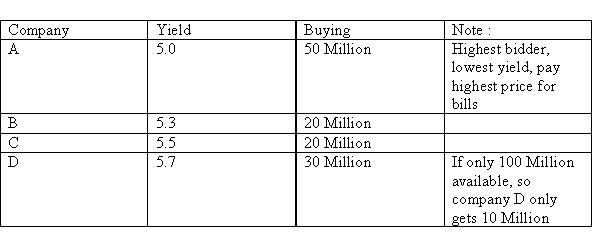

2. Primary Market

![]() issued on an auction basis

issued on an auction basis

![]() 3 and 6 months : auction

every Monday

3 and 6 months : auction

every Monday

![]() 1 year : 3rd week of every

month

1 year : 3rd week of every

month

![]() Auction is conducted on

a yield basis

Auction is conducted on

a yield basis

![]() competitive basis --

yield

competitive basis --

yield

![]() Non Competitive basis (tenders)

Non Competitive basis (tenders)

small banks will use non competitive since

they donít know how the market is going, they just offer the yield at the

average

of the 4 banks

II

Commercial Paper

![]() Short term unsecured promissory

note

Short term unsecured promissory

note

![]() alternative to bank borrowing

for large corporations with strong credit ratings -- less expensive

alternative to bank borrowing

for large corporations with strong credit ratings -- less expensive

![]() minimum round lot transaction

$100,000

minimum round lot transaction

$100,000

![]() very little secondary trading

very little secondary trading

![]() maturity

maturity

(a) less than 270 days

(b) common range 30-50 days

![]() Yields

Yields

(i) discount instrument

(ii) Commercial paper rate is higher than T-bills

rate because

(a) Credit risk

(b) Less liquid

(c) Interest

earned on T-bills is exempt from state and local income tax

III

Bankerís Acceptance

![]() Purpose facilitate commercial

trade transactions

Purpose facilitate commercial

trade transactions

![]() market has been shrinking

since 1984

market has been shrinking

since 1984

![]() sold on a discounted basis

sold on a discounted basis

IV

Large denomination Negotiable Certificate of Deposit

![]() Issued by a bank on thrift

Issued by a bank on thrift

![]() raise fund for financing

their business activities

raise fund for financing

their business activities

![]() insured by FDIC up to $100,000

insured by FDIC up to $100,000

![]() Negotiable CD --

initial depositors can sell CD in the market before maturity

Negotiable CD --

initial depositors can sell CD in the market before maturity

![]() large denomination ($1

Million or more) vs. small denomination (less $100,000)

large denomination ($1

Million or more) vs. small denomination (less $100,000)

![]() Primary source --

money center banks and large regional bank

Primary source --

money center banks and large regional bank

![]() Large banks issue CD like

those headquarters in New York but small bank sources are from deposits

Large banks issue CD like

those headquarters in New York but small bank sources are from deposits

![]() Maturity

Maturity

(a) Most less than one year

(b) maturity more than 1 year are known as term

CD

![]() Yields

Yields

(a) the credit rating of the issuing bank

(b) maturity of CD (longer maturity, higher the

yield)

(c) Supply and Demand for CD

![]() Reserve Requirement

Reserve Requirement

V

Repurchase Agreement

![]() Collateralized borrowing

Collateralized borrowing

![]() to borrow, you sell securities

overnight, then repurchase in the morning

to borrow, you sell securities

overnight, then repurchase in the morning

![]() term of the loan

term of the loan

(a) one day -- overnight repo

(b) more than one day -- term repo

![]() reverse repo : from customerís

view

reverse repo : from customerís

view

![]() repo rate less cost of

bank financing

repo rate less cost of

bank financing

![]() net borrowers : banks and

trifts

net borrowers : banks and

trifts

![]() probiders of funds : MMF,

muncipalities corporation, bank trust department

probiders of funds : MMF,

muncipalities corporation, bank trust department

![]() no one repo rate

no one repo rate

![]() dollar interest on a repo

transaction

dollar interest on a repo

transaction

![]() interest = principal X

repo rate X repo term / 360

interest = principal X

repo rate X repo term / 360

VI

Federal Funds

![]() Reserves deposited at banksí

district Federal Reserve Banks

Reserves deposited at banksí

district Federal Reserve Banks

![]() no interest

no interest

![]() Federal Fund rate and repo

rate tie together (Both are a means for a bank to borrow

Federal Fund rate and repo

rate tie together (Both are a means for a bank to borrow

![]() most term : Overnight

most term : Overnight

(a) Repo : Collateralized loan -- below Federal

fund rates

(b) Federal Fund -- Unsecured borrowing, determining

general level of repo rate