Portfolio Theory

![]() Selection of securities

that maximize expected return subject to a level of risk which is acceptable

to an investor

Selection of securities

that maximize expected return subject to a level of risk which is acceptable

to an investor

![]() Capital Market Theory (CAPM)

Capital Market Theory (CAPM)

![]() Theoretical relationship

between risk and return

Theoretical relationship

between risk and return

I

Measuring investment return

V1 – V2 + D

Rp = ----------------

V0

Where V1 : portfolio MV of the end of the interval

Where V0 : portfolio MV of the beginning of the interval

Where D : Cash distribution during the interval

II

Risky Assets and Risk Free Assets

![]() Future return that will

be realized is uncertain

Future return that will

be realized is uncertain

![]() Risk Free asset (riskless)

Risk Free asset (riskless)

![]() Short term obligation of

US government

Short term obligation of

US government

III

Measuring Portfolio returns and risk

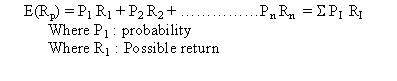

1. Expected portfolio return (mean) – Expected mean

![]() Quantify the uncertainty

about the portfolio return

Quantify the uncertainty

about the portfolio return

![]() Specify the probability

associated with each of possible future returns

Specify the probability

associated with each of possible future returns

Note : Sum of probabilities

= 1

![]() Given this probability

distribution, we can measure the expected return

Given this probability

distribution, we can measure the expected return

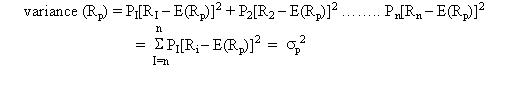

2. Variability of E(Rp)

![]() measure risk by the

dispersion of the possible returns

measure risk by the

dispersion of the possible returns

![]() measure : variance

or standard deviation (weighted sum of the squared deviation from E(Rp)

)

measure : variance

or standard deviation (weighted sum of the squared deviation from E(Rp)

)

IV

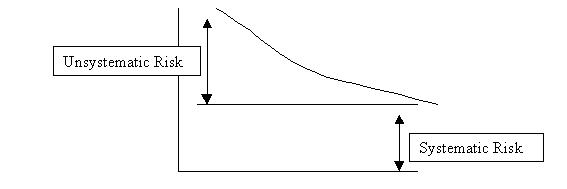

Diversification

![]() combining stocks into a

portfolio to reduce the variance of the returns on your portfolio

combining stocks into a

portfolio to reduce the variance of the returns on your portfolio

![]() while holding returns constant,

reduce risk by adding more securities

while holding returns constant,

reduce risk by adding more securities

Total Risk

1. Systematic Risk (nondiversifiable risk)

![]() risk that cannot

be eliminated by portfolio combination (market related risk) proxy : S&P

500

risk that cannot

be eliminated by portfolio combination (market related risk) proxy : S&P

500

2. Unsystematic Risk (diversifiable risk)

![]() much of the total

risk of individual security is diversifiable

much of the total

risk of individual security is diversifiable

![]() unique to the security

unique to the security

(a) Diversification results from combining securities whose returns

are less than perfectly correlated in order to reduce portfolio

risk

![]() less correlation

--- greater diversification --- risk reduced

less correlation

--- greater diversification --- risk reduced

(b) well diversified portfolio basically carry market risk only.

covariance = how well they move together

correlated may measure linear

cov (x,y) = P1(X1 – E(X))(Y1 - E(Y))

= P2(X2 – E(X))(Y2

- E(Y))

if cov (X,Y) = 1000

cov (W,Z) = 500

can’t compare the covariance directly from the number

Correlation {-1, 0, +}

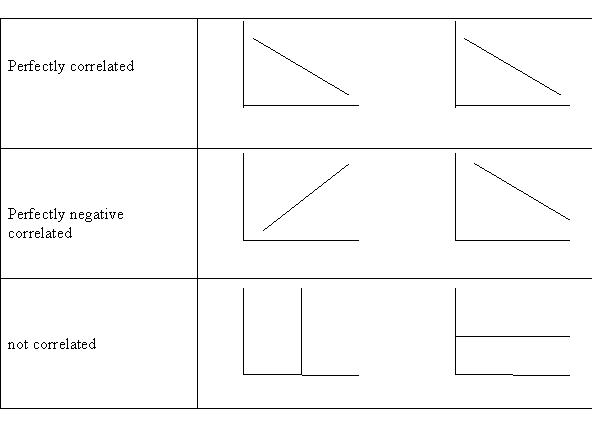

p = 1 : perfectly correlated (positively)

p = 0 : not correlated

p = -1 : perfectly negatively correlated

EXAMPLE

Portfolio choice

![]() 3 state of the world (a,

b, c)

3 state of the world (a,

b, c)

![]() two securities (x, y)

two securities (x, y)

| State | A | B | C |

| Probability | 0.25 | 0.5 | 0.25 |

| x | 20% | 10% | 0% |

| y | -5% | 10% | 25% |

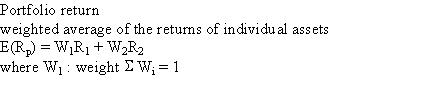

(A)

Expected Return of X and Y

E(X) = 0.25(20) + 0.5(10) + 0.25(10)

= 10%

E(Y) = 0.25(-5) + 0.5(10) + 0.25(25)

= 10%

(C )

Portfolio XY formed of one share of X and one share of Y

E(XY) = E(Rp)

= 0.5(10) + 0.5(10)

= 10%

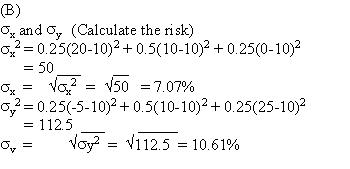

V

Portfolio Theory

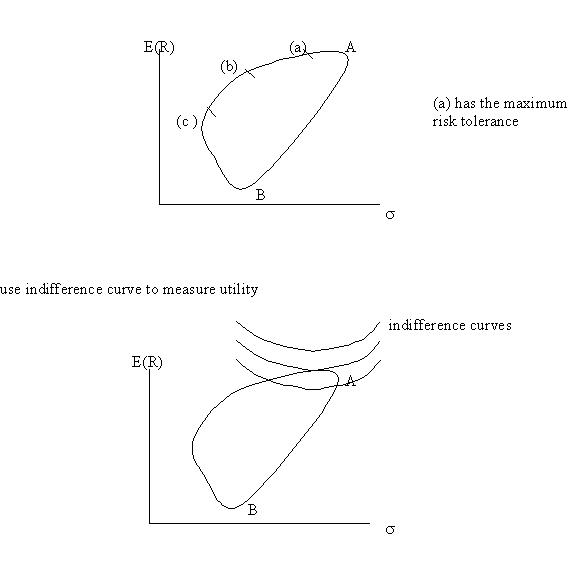

![]() Construction of portfolio

that have the highest expected return at a given level of risk

Construction of portfolio

that have the highest expected return at a given level of risk

![]() Mean (return) – variance

(risk) efficient portfolio --- Markowitz Efficient portfolio

Mean (return) – variance

(risk) efficient portfolio --- Markowitz Efficient portfolio

![]() Assumption

Assumption

(a) only 2 parameter affect an investor’s decision(mean a variance)

(b) variance are risk averse

(c) investor seek to achieve the highest E(R) at a given level of risk.

![]() Between point 2 and 4,

choose 4 since it return better benefits at the same risks

Between point 2 and 4,

choose 4 since it return better benefits at the same risks

![]() Point 5 is not real because

beyond the efficient frontier

Point 5 is not real because

beyond the efficient frontier

![]() Investor choose any portfolio

along the blue line (efficient frontier) that starts from MVP to the tip

of the A

Investor choose any portfolio

along the blue line (efficient frontier) that starts from MVP to the tip

of the A

2. Choosing a portfolio in the Markowitz efficient set

![]() investors want to hold

one of the portfolio on Markowitz efficient frontier (MEF)

investors want to hold

one of the portfolio on Markowitz efficient frontier (MEF)

![]() portfolio on MEF ---

trade offs in term of risk and return

portfolio on MEF ---

trade offs in term of risk and return

![]() Optimal portfolio --- depends

on investor’s preference or utility (given investor’s tolerance to risk)

Optimal portfolio --- depends

on investor’s preference or utility (given investor’s tolerance to risk)